Total Family Income (Gross) for the Last Six Months

Gross Income Formula (Table of Contents)

- Formula

- Examples

- Reckoner

What is Gross Income Formula?

For companies, the term "gross income" means the turn a profit of a company that is obtained when from total acquirement the costs that can be directly assigned to the product procedure is deducted. Such costs are collectively called cost of goods sold or price of sales. Although not all, some of the companies study gross income as a separate line item in their income argument. The gross income is popularly known equally gross profit. The formula for gross income can be derived by deducting the price of goods sold (COGS) from the full sales of the visitor. Mathematically, information technology is represented as,

Gross Income = Full Sales – COGS

Examples of Gross Income Formula (With Excel Template)

Let's have an example to sympathize the calculation of Gross Income in a ameliorate fashion.

You tin download this Gross Income Formula Excel Template here – Gross Income Formula Excel Template

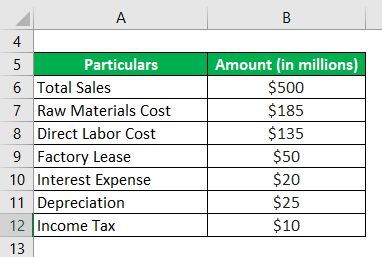

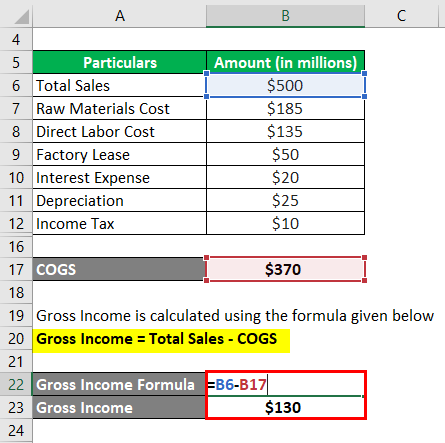

Gross Income Formula – Instance #one

Let us take the instance of SDF Inc. to illustrate the computation of gross income. The visitor articles rigid and flexible packaging products and has its manufacturing facility in Illinois, US. According to the recently published almanac report of the visitor for the year 2018, the post-obit information is available, Calculate the gross income of SDF Inc. for the year 2018 based on the given information.

Solution:

COGS is calculated using the formula given below

COGS = Raw Materials Toll + Direct Labor Cost + Factory Charter

- COGS = $185 meg + $135 million + $fifty million

- COGS = $370 million

[Since interest expense, depreciation and income taxation are not a direct price of production, these costs are non considered in the computation of COGS]

Gross Income is calculated using the formula given below

Gross Income = Total Sales – COGS

- Gross Income = $500 million – $370 1000000

- Gross Income = $130 one thousand thousand

Therefore, SDF Inc. booked a gross income of $130 one thousand thousand during the year 2018.

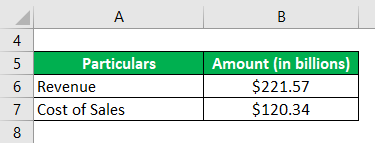

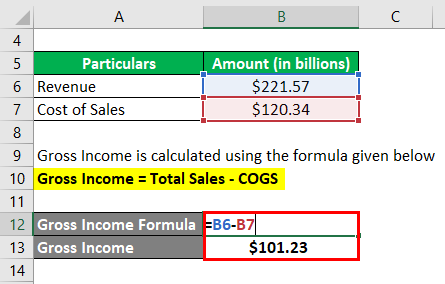

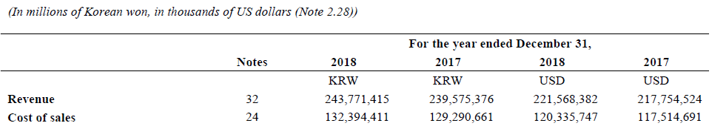

Gross Income Formula – Example #two

Allow us have the example of Samsung to illustrate the ciphering of gross income. According to the annual report for 2018, the company registered a revenue of $221.57 billion, with the corresponding toll of sales of $120.34 billion. Calculate the gross income of the visitor for the twelvemonth 2018.

Solution:

Gross Income is calculated using the formula given below

Gross Income = Revenue – Cost of Sales

- Gross Income = $221.57 billion – $120.34 billion

- Gross Income = $101.23 billion

Therefore, Samsung managed a gross income of $101.23 billion during the year 2018.

Source Link: Samsung Balance Sail

Gross Income Formula – Example #3

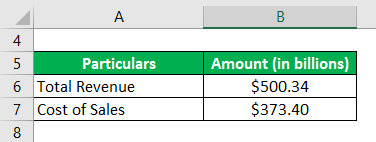

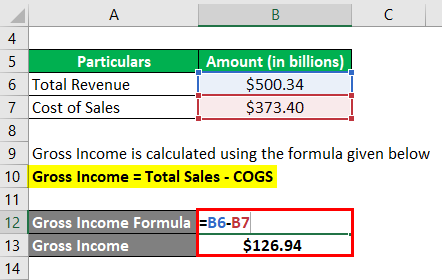

Permit us at present take the case of Walmart Inc. to illustrate the computation of gross income. During 2018, the company recorded total revenue and cost of sales of $500.34 billion and $373.40 billion respectively. Calculate the gross income of the company for the twelvemonth 2018.

Solution:

Gross Income is calculated using the formula given beneath

Gross Income = Total Revenue – Price of Sales

- Gross Income = $500.34 billion – $373.40 billion

- Gross Income = $126.94 billion

Therefore, Walmart Inc. secured a gross income of $126.94 billion during the year 2018.

Source Link: Walmart Inc. Residual Sheet

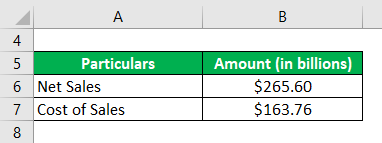

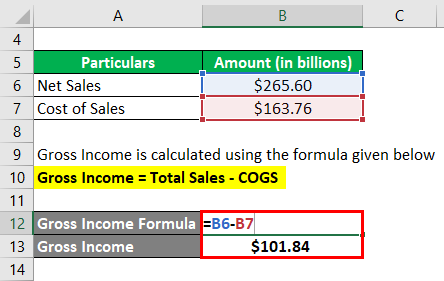

Gross Income Formula – Example #4

Allow us now accept the case of Apple tree Inc. to illustrate the computation of gross income. Every bit per the latest annual report, the company booked net sales of $265.sixty billion and a cost of sales of $163.76 billion during the year 2018. Calculate the gross income of the company for the year 2018.

Solution:

Gross Income is calculated using the formula given below

Gross Income = Net Sales – Cost of Sales

- Gross Income = $265.lx billion – $163.76 billion

- Gross Income = $101.84 billion

Therefore, Apple Inc. booked a gross income of $101.84 billion during the twelvemonth 2018.

SourceLink: Apple Inc. Remainder Canvas

Explanation

The formula for gross income can exist derived by using the following steps:

Footstep i: Firstly, figure out the total sales of the visitor, which is typically the start line item in the income statement of any company.

Footstep 2: Next, decide the directly assignable cost or COGS from the income argument. It is the amass of all the costs of production that can be directly assigned to the product process. COGS primarily comprises of raw material cost, direct labor cost and manufacturing overhead (factory rent, insurance, etc.).

COGS = Raw Material Cost + Direct Labor Toll + Manufacturing Overhead

Stride 3: Finally, the formula for gross income can exist derived by deducting COGS (step two) from total sales (step 1) of the company as shown below.

Gross Income = Total Sales – COGS

Relevance and Use of Gross Income Formula

It is important to understand the concept of gross income because it indicates the first line of profitability of a visitor, which in turn indicates its operational efficiency. The metric captures how many dollars the company could generate in turn a profit after deducting the direct assignable costs of production. Further, this metric is predominantly used for calculating the profitability ratio of gross profit margin where gross income is the numerator and total sales are the denominator.

Although gross income computation includes the directly cost of production of goods and services, it fails to accept into business relationship the other costs related to selling activities, such every bit assistants, taxes, etc., which is one of the major limitations of this metric.

Gross Income Formula Calculator

You can use the post-obit Gross Income Formula Calculator

| Total Sales | |

| COGS | |

| Gross Income | |

| Gross Income = | Total Sales – COGS |

| = | 0 – 0 |

| = | 0 |

Recommended Manufactures

This is a guide to Gross Income Formula. Here we talk over how to calculate Gross Income along with practical examples. We also provide a Gross Income calculator with a downloadable excel template. You may besides wait at the following articles to acquire more –

- Formula for Disposable Income

- How to calculate Aggregate Demand

- Example of Turn a profit Percentage

- Adding of Cyberspace Interest Margin

- Difference between Income Tax vs Payroll Tax

Source: https://www.educba.com/gross-income-formula/

0 Response to "Total Family Income (Gross) for the Last Six Months"

Post a Comment